If you're in the market for a new car in Ireland right now, you don't need us to tell you about supply chain issues. First Covid-19 (and the effects of the pandemic are still being felt), then a worldwide lack of semiconductors and now the invasion of Ukraine by Russia: the result is a serious shortage in stock of new cars in Ireland (and further afield). Many readers have spoken to us about the situation and there is frustration out there, compounded by the fact that there's particularly strong demand for new electric cars this year. We thought it would be useful to hear from all the Irish distributors on the subject.

BMW

Robert Frame is Head of Sales and Marketing at BMW Ireland:

In general, how are stock levels looking across your dealer network?

"We sell cars to order rather than having a certain level of stock, as this ensures customers have more input into the look, feel and options they desire for their new BMW or MINI. We have a range of brand-new electric models being launched this year, so we have been able to meet customer demand so far this year.

"However, the war in Ukraine is impacting supply. Combined with the ongoing semiconductor bottlenecks, these supply limitations have led to production adjustments and downtimes at some of our production plants."

Will there be sufficient stock for the '222' plate change month?

"The difficult supply situation means individual adjustments are still being made to the production programme, with a corresponding impact on sales. We expect the supply situation for semiconductor components and impact of war to remain difficult again this year."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"We work closely with our retail partners to future-plan and allocate quota that will satisfy demand. Some of our retailer's orders are further forward sold than others and with adjustments that have had to be made, some will now be delivered in 2023.

"It is important to note that all industries are having similar supply and production constraints and the BMW Group has adopted its own approach to secure the supply over the long term, focusing on availability, longer-term price stability and sustainability.

"Overall, the BMW Group is very well prepared to deal with the usual fluctuations in the market. It has years of experience and extensive know-how in global raw materials markets."

Citroen

In general, how are stock levels looking across your dealer network?

"Stock is low at present in the network."

Will there be sufficient stock for the '222' plate change month?

"At present, our demand outweighs supply for 222."

Can you comment separately on the situation specifically relating to your fully-electric models?

"We were hoping to launch our 75kWh batteries soon but due to component shortages, 50kWh is all that is available at present."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"This varies by model, so we are encouraging customers to stick to the model trimline structure without additional options to ensure minimal delays."

Ford

John Manning, Market Lead at Ford Ireland, answered our questions:

In general, how are stock levels looking across your dealer network?

"Stock levels generally across our dealer network are challenging, which is something that is shared to a large degree by all our competitors in the market today. The global impact of the semiconductor chip supply constraint that first materialised in mid-2021 has been the primary catalyst but further compounded by lockdown actions taken in Asia and of course the unjust and atrocious actions of Russia in Ukraine.

"Of course, unlike many of our competitors today, Ford is not just focusing on passenger car customers, but we also have an obligation to focus equally on our commercial vehicle customers. Despite this, our network continues to remain steadfast and are maximising their sales potential from available stock in the market and doing so whilst serving the needs of their customers every day. Of course, our network and indeed the wider industry would all favour improved stock levels, which I have no doubt would result in an improved industry outlook, but stock levels will continue to remain a challenge into the short to medium term for the wider vehicle industry."

Will there be sufficient stock for the '222' plate change month?

"We plan to have sufficient stock cover across both passenger car and commercial vehicles to meet our objectives for the given period."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"This really can depend on a lot of moving parts, right from the model to the types of specification chosen by the customer. Not taking account of unforeseen variables/disruptors in the supply chain, which can have minor to major implications on lead times, the average and typical lead time of a situation as described in the question at this time can vary anywhere between 12 and 26 weeks.

"What we can say is that at any given time our fullest intent is to be transparent with the customer regarding their lead time and this is the reason we have introduced a fluid process called the 'Ford Welcome Programme', which notifies our customer directly on where their vehicle is at specific stages in the production and delivery process, all designed to keep the customer informed and build on the trust they have given Ford to manufacture and deliver their choice of product."

Mazda

In general, how are stock levels looking across your dealer network?

"We have been impacted by a number of production cuts globally that has shifted stock numbers across different markets depending on profit levels and volumes. Each production cut has impacted our available stock here in Ireland, but this varies depending on model and spec. We are offering certain models and grades without Bose speakers should a customer be happy to order a vehicle with the standard eight-speaker set up, which allows us to manage supply and demand a bit better. It is not ideal, and we are patiently waiting for the return to normal supply levels so that dealers can offer the grades most in demand and turnover appropriate sales volumes."

Will there be sufficient stock for the '222' plate change month?

"Yes and no, but really it is hard to say as we are already experiencing a wave of demand over recent weeks. Mostly yes for models like Mazda CX-5 and CX-30, but no for Mazda3 and Mazda2. The former still carry less than we would like, but the choice of no Bose on top grades seems to be a solution, particularly for customers who typically listen to radio and podcasts over music. The latter will still be in stock, but just not as plentiful. The recent upsurge in demand is building strong pre order numbers. Should the demand continue throughout the next two months, we may sell out quicker than what we had anticipated, across all model lines."

Can you comment separately on the situation specifically relating to your fully-electric models?

"MX-30 is one of the models we will have limited stock of for the 222 plate, possibly the most limited for the meantime. This is due to strong demand across Europe selling out the current model before the updated model lands, which is due in August. We should have sufficient stock then and a newer car with a faster charging capability and new colour options."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"It depends really. We only carry so much stock, but we are working together with Mazda Europe on central stocking solutions. This is still somewhat in its infancy, especially for right-hand-drive models, so over time it will significantly improve. Right now, should a particular model or grade not be in stock here, but we can access it from another market, it may be up to three months. Should we need to order and build, it could be anything from three to six months depending on that model or grade."

Mercedes-Benz

In general, how are stock levels looking across your dealer network?

"Stock levels are improving very slowly. Currently, there is no free stock available as new stock arrivals are delivered straight to dealers."

Will there be sufficient stock for the '222' plate change month?

"We expect to have about 60 per cent of requirements, as semiconductors remain an issue."

Can you comment separately on the situation specifically relating to your fully-electric models?

"Electric vehicles are affected by the same semiconductor challenges. New model arrivals are slower than usual due to the component supply issues; however, we expect this issue to improve later in in the year."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"It depends on the model. As a guide, the earliest would be Q4 2022, more likely to be Q1 or Q2 2023."

MG

In general, how are stock levels looking across your dealer network?

"Stock levels have been low to date, but we are working hard with the manufacturer to improve this for the second half of the year."

Will there be sufficient stock for the '222' plate change month?

"Consumer demand has been very strong for MG EVs and while we are aiming to deliver as many of these as we can for the 222 plate, we won't have sufficient stock to satisfy all new orders this year."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"This will come down to the model, as we would have more availability of our PHEV model this year compared to our BEVs. We're now taking BEV orders for Q1 of 2023."

Opel

James Brooks, Managing Director of Opel Ireland, answered our questions:

In general, how are stock levels looking across your dealer network?

"The global chip shortage has had a significant impact on automotive supply chains, and the majority of brands in Ireland have unfortunately seen a reduction in free stock levels sitting on forecourts. We have worked with our manufacturer closely for months to secure adequate production throughout 2022, culminating in an increased market share year to date."

Will there be sufficient stock for the '222' plate change month?

"The seasonality of the Irish new vehicle market is very well documented and our manufacturer is working closely with us to secure production to feed the traditional July surge in demand. As such, we anticipate our stock to at least meet the same level as last year. However, we advise customers to order early to avoid disappointment, to stay in contact with their chosen local dealer and we ask customers to please understand the very fluid nature of the automotive business at present."

Can you comment separately on the situation specifically relating to your fully-electric models?

"Certainly the more chips needed for a model, particularly in the case of electric models, the more difficult the supply chain is at present. Fully electric and plug-in electric hybrid model production is particularly difficult to secure at present."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"Currently, we have temporarily suspended optional extras on certain models, in order to secure production for customer orders. We are operating a very stringent stock management flow, based on standard trims, to mitigate customer delivery delays where possible."

Peugeot

Des Cannon, Managing Director of Peugeot Ireland, answered our questions:

In general, how are stock levels looking across your dealer network?

"The Peugeot dealer network is doing a fantastic job with reduced operating stock levels to try and meet our customer needs. Peugeot, like all brands has lower stock levels than the market demand requires, however most customers understand the serious constraints across our industry and have stuck with us in holding out for their production slot - by now the vast majority of customer orders have been cleared from January. Quarter one this year was sparce, but we are now building a healthy stock of our volume sellers in anticipation of July."

Will there be sufficient stock for the '222' plate change month?

"We would like to think so; we worked very closely with the manufacturer in France to optimise our production allocation in advance of our July 222 plate change. We are certainly better placed now than we were in January this year, and are hopeful to register more vehicles for the July 222 plate than in January. Light commercial vehicles, however, continue to be heavily constrained, so overall a better outlook for our passenger car range."

Can you comment separately on the situation specifically relating to your fully-electric models?

"EV and LEV penetration for the Peugeot brand has grown considerably in a very short period of time. We launched our first full EV in 2019 and 18 months ago our LEV volume mix was 0.8 per cent. By the end of last year it moved to 12 per cent and now our LEV mix is at 21 per cent. We have invested significantly in LEV advertising and training and our dealer network has done a phenomenal job in rolling it out. Are there production constrains? Certainly, but they will not last forever and we at Peugeot look forward to growing our LEV market share in the coming years."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"Regrettably, due to the severe impact of component supply issues, we were forced to close our special order facility where customers could configure their unique specification needs. To optimise manufacturing capacity we currently order key core selling models and versions to secure the maximum production every month. In the past up to 40 per cent of our customer orders were bespoke, which has been a huge contributor to our move upmarket. We still offer the power of choice to our customers, where they can select a preferred powertrain - be it electric, PHEV, petrol or diesel and have a good selection of grades available across our model range, but for now special orders are on hold."

Renault

Jeremy Warnock, Group Product Supply and Distribution Manager at Renault Ireland:

"Supply right now in mid-May is very tight. Renault and Dacia factories are constrained on supply and are building vehicles for markets where they will be registered as quickly as possible. Due to traditionally low sales volumes in the second quarter in Ireland, other markets are currently being prioritised.

"Soon however, this policy will begin to play in our favour with arrival volumes ramping up in June for our July sales peak, and continuing in July and August. In particular, we have received generous allocations of Dacia Duster, Renault Clio and Renault Captur and will be well positioned to meet customer demand for these cars. Customers wishing to secure a Renault Arkana, Dacia Sandero or the all-new Dacia Jogger seven-seater will have to be quick though - we still have some free volume in the production plan, but allocations are selling fast.

"In respect to electric cars, the Zoe E-Tech is selling very well. More customers than ever are interested in making the switch to clean and affordable electric motoring. And the good news is that although stocks are low today, we have a good allocation of cars arriving in time for the 222 plate in July.

"The only real issue on supply is vans. We have limited availability on Renault Trafic, with new orders expected to be supplied in September and Q4, while all current Renault Master allocations are sold, with delivery on fresh orders unlikely before 2023. We don't yet know how supply will look on the (International Van of the Year) all-new Renault Kangoo, but we're already taking orders against a supply plan that doesn't begin until September."

SsangYong

John McKenna, Country Manager for SsangYong, answered our questions:

In general, how are stock levels looking across your dealer network?

"We have had stock arriving since March, with further deliveries coming in May and June of the Korando 1.6 diesel and Tivoli 1.2 petrol; these are all for immediate delivery or for July 222 registrations."

Will there be sufficient stock for the '222' plate change month?

As above, we will have deliveries of the Korando and Tivoli, and in July we will have the Musso and Rexton delivered with a second delivery in August.

Can you comment separately on the situation specifically relating to your fully-electric model?

"SsangYong has already launched the Korando eMotion EV earlier this year in left-hand drive, and we would hope to take delivery of this in right-hand drive later this year. The company has already developed its second full EV, code name J100; it's a completely new platform and vehicle. This will go into production in August 2022."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"Any special order vehicle will have a 12- to 16-week order-to-delivery timeframe, and of that, approximately 12 weeks is the shipping."

Suzuki

In general, how are stock levels looking across your dealer network?

"Overall, our sales this year are in line with last year (Suzuki +2 per cent versus market +5 per cent). Thankfully, we ordered in line with our growth objectives and while struggling with factory constraints (semiconductors), we expect to be in line or ahead of market in 2022."

Will there be sufficient stock for the '222' plate change month?

"By and large, yes. We have advised dealers that our arrivals will be later than the actual month of July and shall be spread over Q3. We have restricted production of some Japanese built cars, such as the Ignis and Swift."

If a buyer wants a specific model to a particular specification, and they order it now, when are they likely to take delivery?

"Towards the end of the year."

Volkswagen

"Due to a series of unprecedented, external factors, the supply situation for Volkswagen, and indeed the entire automotive industry, remains volatile in 2022. Waiting times vary depending on model. For instance, vehicles like the Golf, Tiguan and ID.3 are experiencing longer lead times than usual. Whereas other models, such as the new Taigo, new T-Roc and T-Cross, are closer to normal expected lead times.

"We have just launched the new ID.5 and this exciting coupe EV will make its Irish market introduction in June with limited deliveries planned for Q3. The ID.4 was Ireland's best-selling EV in 2021 and is experiencing continued high demand in 2022 with limited stocks arriving at dealers nationwide from June to September. Lines with high dependency on semiconductors have longer lead times with some models currently scheduled for 2023 delivery.

"We would like to sincerely thank any customers affected for their patience and understanding at this time of upheaval. We are doing everything within our power to deliver their cars as soon as possible. Volkswagen Ireland and its network of retailers nationwide will continue to fulfil customer orders throughout the rest of 2022. In the meantime, we would advise all customers to contact their preferred Volkswagen retailer to discuss their models of interest and get the latest information on lead times."

Volvo

Alan Cowley, Commercial Operations Director at Volvo Car Ireland commented:

"Earlier in the year, Volvo Car Ireland enjoyed relatively short lead times on most of our key models, which helped build a strong order bank for the 222 registrations. These cars will start to arrive to customers in July and we are pleased to see a high proportion from our Recharge line up - a promising step towards the all-electric future of Volvo Cars.

However, like the automotive industry as a whole, we still experience some volatility due to a combination of semiconductor shortages and Covid-19 outbreaks in our supply chains. This, coupled with high customer demand, mean that new cars orders now have a lead time of approximately six months. Next month, we will have confirmed new car prices, so that our retailer network can start taking orders for January 2023 delivery."

What are semiconductors and why is there a shortage for cars?

Semiconductors are more commonly known as computer chips and, usually made of silicon, they're found in nearly all electronic devices from games consoles to smartphones to everyday household appliances and cars.

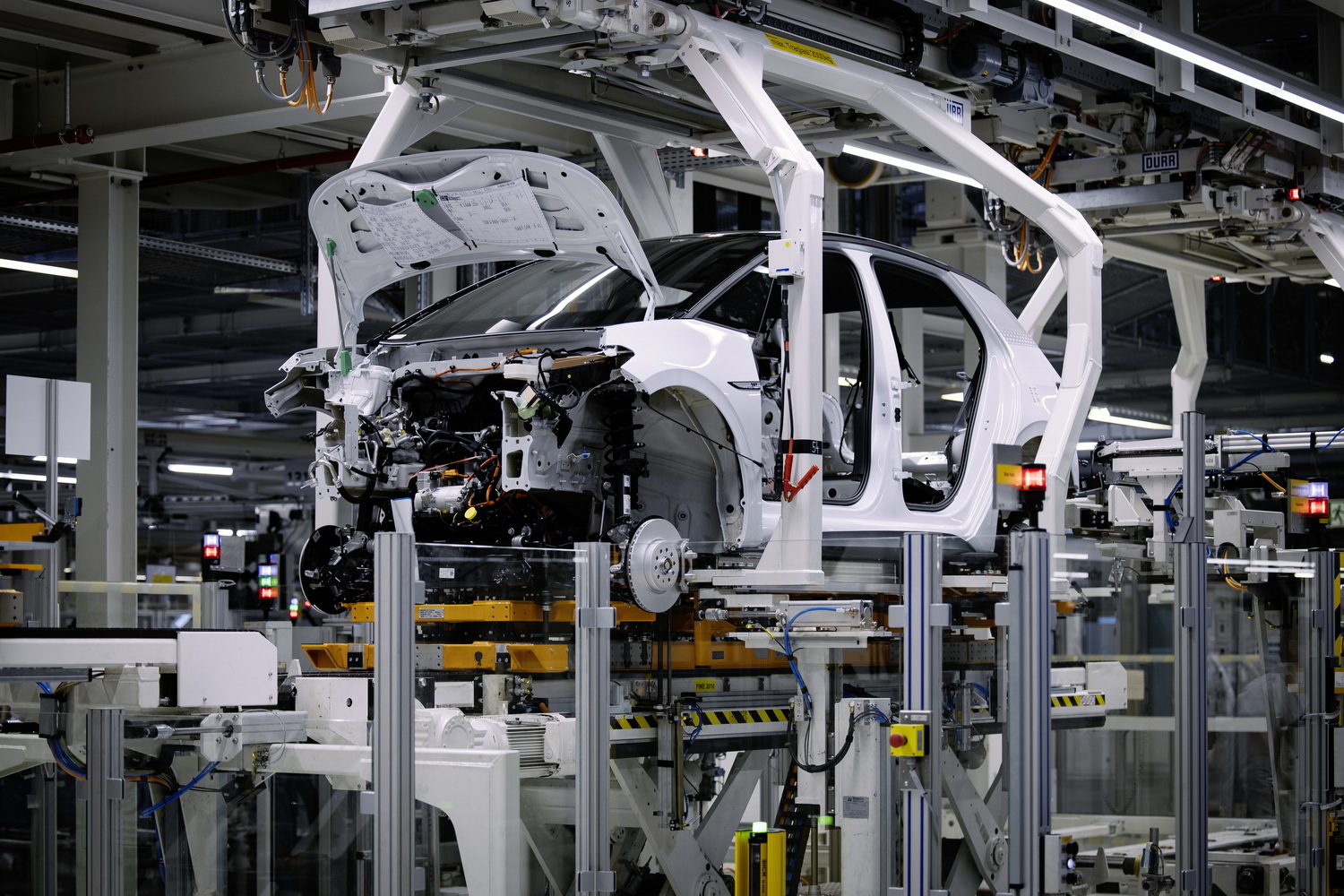

Nearly every function in a modern car is governed by semiconductors (digital speedometers, power steering, infotainment systems, safety devices, driver assistance features, powertrain management and more) to a point where, with all the systems combined, a car can easily have upwards of 3,000 semiconductors on board. They're an absolutely integral part of every new car and any disruption to supply would severely hamper carmakers' abilities to get vehicles out the factory door - which is exactly what has happened.

When the Covid pandemic hit in early 2020, car dealerships and thus factories were temporarily shuttered. While car sales practically dried up, a boom occurred in consumer electronics meaning that chip manufacturers decided to focus instead on those more lucrative clients than carmakers. Car production makes up a comparatively small part of the overall demand for chips, accounting for just three per cent of the 2020 output of one of the world's biggest chip manufacturers, the Taiwan Semiconductor Manufacturing Company, for example.

Semiconductor manufacturing is only really a profitable enterprise when chips are being made in extremely high volumes, meaning that the car industry is dependent on quite a small number of chipmakers. A disruption to supply at any one plant worldwide can have knock-on effects across the industry. One such event occurred last year at the Renesas Electronics factory in Japan, which supplied semiconductors for use in safety-critical automotive systems. Computer chips also require vast quantities of pure water during their manufacture, and a drought in Taiwan in 2021 also curtailed production.

The effect of the shifting priorities among chipmakers, as well as these other events, is that - although demand for new cars is soaring thanks to a post-pandemic bounce - there aren't nearly enough cars to meet that demand, due to the fact that manufacturers can't get their hands on enough computer chips. Lead times for new cars are now, in some cases, over a year, despite unfinished vehicles piling up outside factories all over the world awaiting computer-controlled parts to finish them off. Audi's particularly creative solution in the United States has been to launch the Semiconductor Shortage Pack, which deletes a few high-tech items such as adaptive cruise control in favour of giving eager buyers a small discount (there's no such plan for the Irish market that we are aware of).

The shortage of new cars has in itself led to further effects such as huge hikes in the price of used cars and sky-high rental costs as car hire companies struggle to replace the fleets they sold off when the pandemic hit.

While the situation has abated slightly, company bosses from Tesla's Elon Musk to Mercedes' Ola Källenius have said that they don't see the problem resolving itself this year and that it could be well into 2023 before the industry gets back to anything approaching normal.

How is the Russian invasion of Ukraine affecting car production?

Although paling into insignificance in light of the human suffering, Russia's invasion of Ukraine in February threw another crisis into the mix for carmakers with Volvo and Jaguar Land Rover among the first companies to halt exports to Russia following the invasion.

With the conflict having turned Ukraine into a war zone, car manufacturers that rely on components from Ukrainian factories have been hit by shortages of important components such as wiring looms. This is due primarily to the closure of two factories belonging to Leoni AG, a German firm operating in Ukraine that supplies wiring to the car industry. German carmakers have been particularly affected with Mercedes, Volkswagen and Audi all reporting temporary factory slow-downs and shut-downs since the war began. Most recently, Audi announced a pause in production of its A4, A5 and A8 models due to supply-chain difficulties caused by the war and the extension of a period of shorter working hours at its Ingolstadt and Neckarsulm factories until the end of May.

Of all the European manufacturers, Skoda seems to be the worst affected with not only the same supply chain problems as the German car companies, but also the closure of its own factory in Solomonovo in western Ukraine, which employed 400 people and produced Fabia, Superb, Karoq and Kodiaq models. Supply-chain difficulties have also affected production of its electric Enyaq iV.

Although Russia itself doesn't produce a huge number of cars for export to Europe and beyond, it does control a significant part of the world's nickel and palladium supply, the former of which is critical for electric vehicle and hybrid battery packs - the latter for use in catalytic converters. Supply of these has not yet been affected, but whether it will potentially happen or not depends on what sanctions other countries decide to impose on Russia due to the ongoing war.

Is Covid-19 still affecting the automotive supply chain?

To an extent, Covid is still playing a part in the problems affecting the global supply chain even beyond the hangover from when chipmakers decided to prioritise consumer electronics over cars.

In an increasingly interconnected global car industry, local outbreaks of Covid around the world will likely affect supply chains for some time depending on how local authorities deal with a given situation. A recent coronavirus outbreak in China, for example, and subsequent lockdowns as part of the country's zero-Covid policy, led to temporary production stoppages at Renault's Douai plant in northern France due to shortages from Chinese parts suppliers. That same Covid outbreak also led to other manufacturers with significant operations in China - such as Tesla, Volkswagen and MG - to halt production, temporarily restricting global supply.