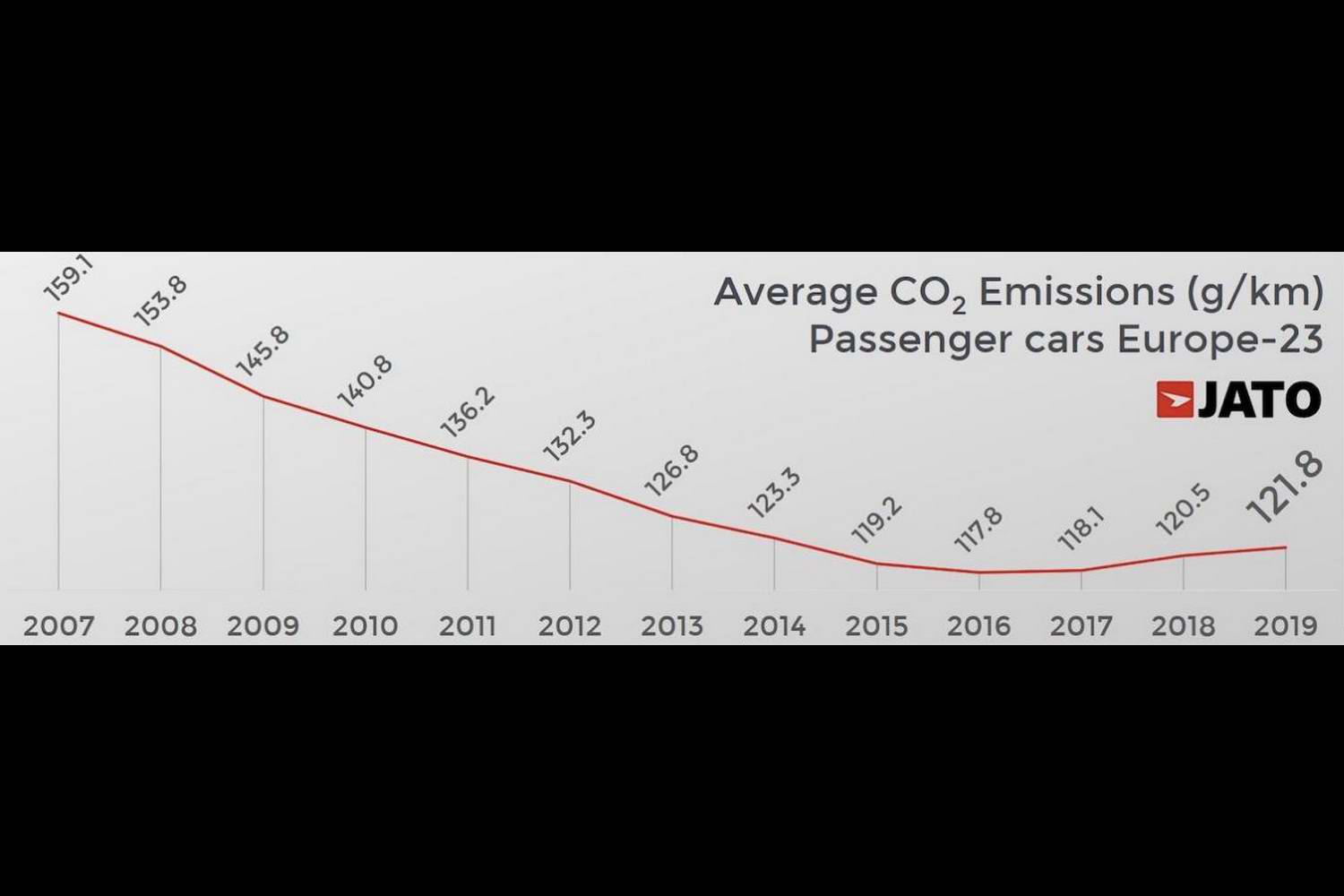

Just when CO2 emissions are supposed to be falling, they're actually going up. According to motor industry analysts JATO Dynamics, carbon dioxide emissions from passenger cars actually went up last year, by 1.3g/km, to an average of 121.8g/km.

EU fines coming down the track

Worse still, that's a figure measured under the old, outdated, NEDC2 test. If measured under the new, more stringent WLTP test, those emissions would almost certainly be much, much higher. It's bad news for Europe's car makers which this year have to start hitting a 95g/km CO2 average across the number of cars that they sell, or face massive fines from the EU.

The only positive thing about the numbers is that the rate of increase has fallen off, down from the 2.4g/km rise seen between 2017 and 2018. According to JATO, the recent rise in the sales of electric cars has not been big enough to compensate for buyers turning away from low-CO2 diesel models, while increasing SUV sales are also to blame.

Felipe Munoz, global analyst at JATO Dynamics explained: "As expected, the combination of fewer diesel registrations and more SUVs continued to have an impact on emissions. We don't anticipate any change to this trend in the mid-term, indeed these results further highlight the industry's need to adopt EVs at a rapid pace to reach emissions targets.

"The average emissions of electrified vehicles, was 63.2 g/km, almost half that produced by diesel and petrol vehicles. The problem arose because EVs only accounted for six per cent of total registrations, which is not yet a high enough figure to create a positive change."

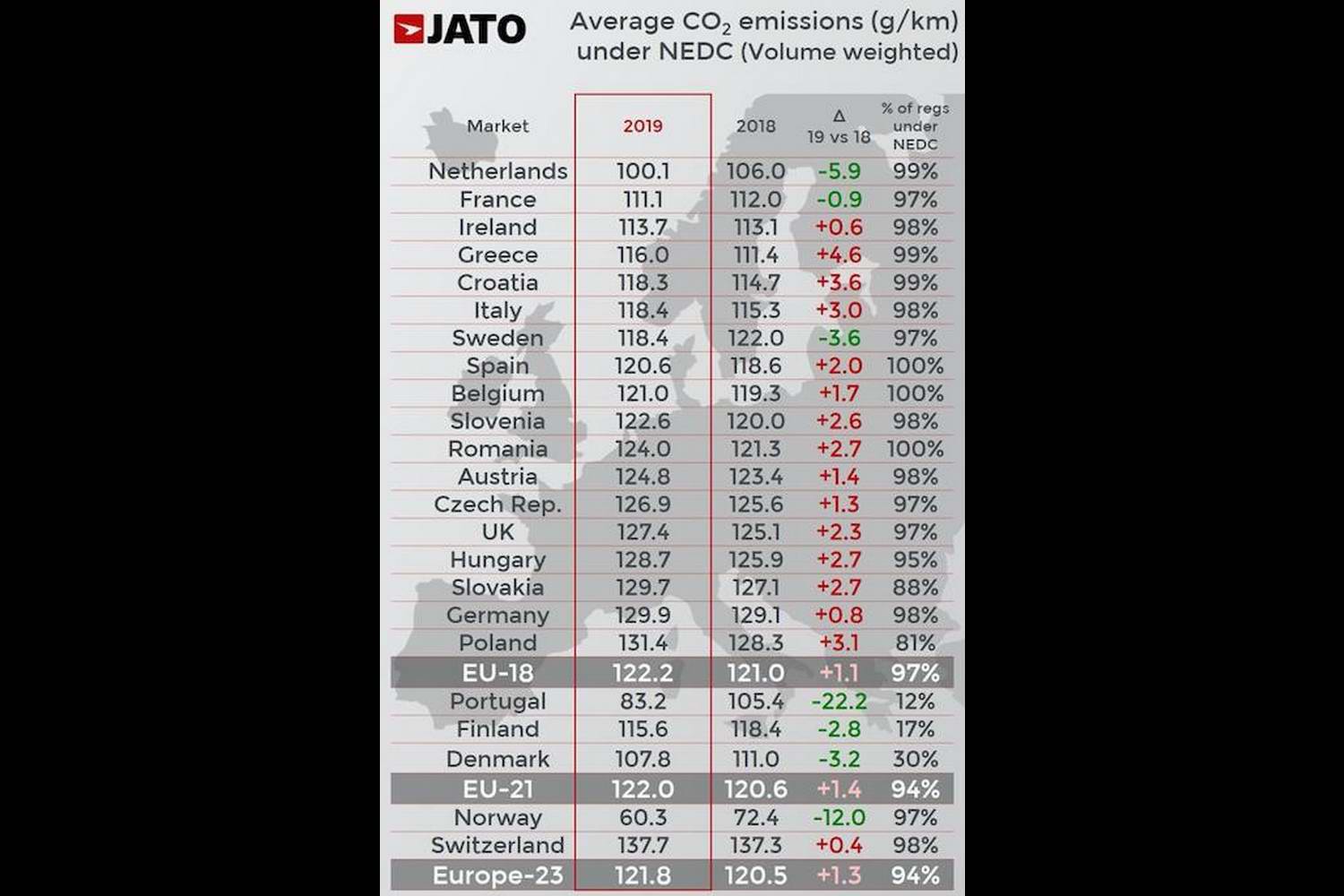

Only France, Sweden, and The Netherlands see emissions decline

Four out of five of the big European car markets posted big rises in average emissions. Germany, for example, saw its vehicle emissions rise by 0.8g/km, while in Italy the number went up by a massive 3.0g/km. Of the big markets, only France saw a decrease, from 112.0 g/km in 2018, to 111.1 g/km last year. In part that's because electric vehicles have a higher market share in France - two per cent - than in any of the other major markets.

Ireland's CO2 emissions rose fractionally, from 113.1g/km to 113.7g/km. We currently have an electric car share that stands at 2.7 per cent of the market. Munoz noted: "Neither the Germans nor the Italians offer pure electric subcompacts within their product line up. These cars can make a huge difference to consumer attitude."

The biggest improvements were made by Sweden, and The Netherlands. That latter country saw emissions fall by 5.9g/km, to an impressive 100.1g/km overall. It's no coincidence that The Netherlands has some of the biggest incentives in Europe for buying an electric car. In 2018, for every EV registered there were 2.3 diesel new cars in the Netherlands; one year later this changed significantly to 1.9 EVs for every diesel car registered.

Toyota the best performing brand (aside from Tesla)

In terms of car brands, Toyota is currently the best-performing overall (not counting Tesla, which of course only sells zero-emission models), trimming its fleet average emissions by 2.3g/km to 97.5g/km. Citroen is next best, on 106g/km, followed by Peugeot on 108g/km (impressive considering that those two brands are only just starting to introduce EVs and plug-in hybrid models). Renault came fourth, on 111g/km, while Nissan was fifth on 115g/km.

Mercedes sits at the bottom of the table, on an average 140g/km (all those AMGs, we guess...) while the worst performing brand in 2019 was - somewhat surprisingly - Suzuki, which saw its average emissions jump by 6.3g/km to an average of 120.6g/km.

Munoz stated: "Toyota is a pertinent case, particularly considering they don't offer pure electric cars but are still ahead of their European peers who still have more electrification plans than actual products. The SUV segment of the market urgently needs more electrified models. To date, the focus for EVs has been on traditional hatchbacks and sedans, leaving very few choices in the SUV market. If these vehicles want to keep gaining traction and avoid future sanctions, they need to be electrified."