What's the news?

With 182 registrations just around the corner, many of us will be thinking of snapping up one of those juicy low-interest PCP (personal contract purchase) deals being offered. But, the financial experts at the Competition and Consumer Protection Commission (CCPC) are saying that we all need to sit down and give ourselves a good talking to before committing to a finance package that many of us don't fully understand.

Speaking today about the campaign, Fergal O'Leary, Member of the Competition and Consumer Protection Commission said: "When you are buying a car there are many considerations to take into account such as makes, models and new versus second hand. For most consumers there is also an added question of what car finance to use. This decision requires careful consideration, however, our research shows that consumers spend less time researching finance options compared to the time spent choosing a car; on average four-and-a-half times longer."

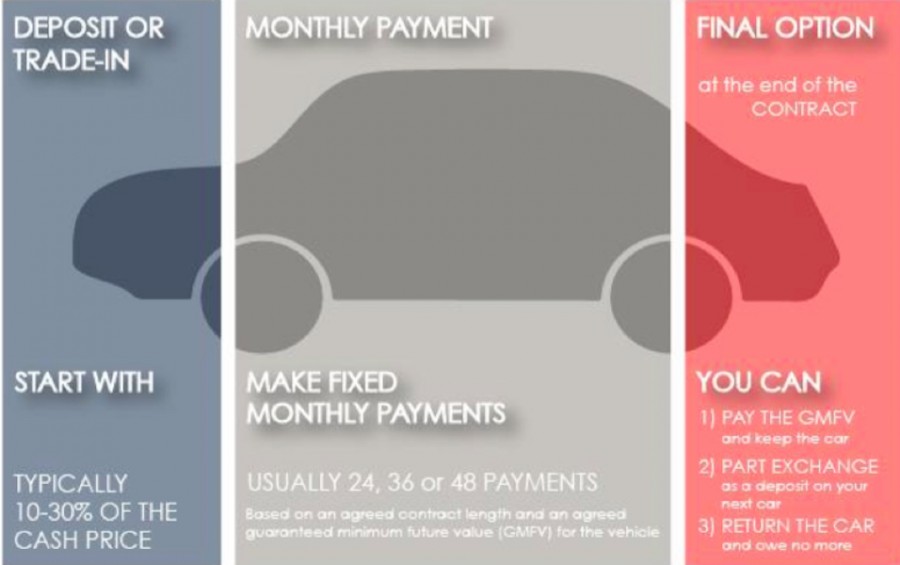

PCPs are, obviously, great in that they come with temptingly low monthly repayments, but the CCPC says we're all focusing too much on that aspect and not enough on the rest of the deal. The Commission is reminding us all that while the car's Guaranteed Minimum Future Value (GMFV) theoretically leaves enough equity in the car's final residual value to act as a deposit for the next purchase, it's not definite and can be affected by market forces. Given the headwinds battering the car market (falling new car sales, increased imports, the spectre of another house price crash) it's probably prudent to be thinking about such things.

For customers who want to own the car outright at the end of the loan, or handing back the keys and walking away, the CCPC's advice is: "it is important that they don't just look at the cost of the monthly repayments but consider how they will pay for the GMFV at the end. If a consumer plans on handing back the keys or entering into a new PCP agreement, there are certain conditions they will need to meet such as mileage limits and servicing requirements, and they will need to return the vehicle in a certain standard. So, it is very important that consumers check all of the details before they sign up."

Speaking about the importance of consumers understanding what they are signing up to, Fergal O'Leary said: "PCPs are significant long-term financial commitments. Our recent report into the market showed that the average PCP agreement, in 2016, was valued at €25,000. The complexity of PCP products, coupled with the value of these agreements, means that it is extremely important that consumers are able to understand what they are signing up to. This can only happen when consumers understand their options and how the product works. Our campaign helps consumers in this regard and makes it easier to understand PCP agreements and to choose a financial agreement that is right for their circumstances".