What's the news?

Carzone.ie has released its half-yearly report into the state of Irish motoring, and the statistics show that one in every two Irish car owners will swap their car for a new one (or at least one that's new to them) every five years. Of those looking to change, 47 per cent will stick with the same brand when shopping for their new wheels.

The Carzone Motoring Report is built up from monitoring the 67 million new and used car searches carried out by Irish consumers on Carzone.ie during the first five months of the year, as well as an in-depth survey of 2,647 Irish motorists and a cross section of car retailers in Ireland.

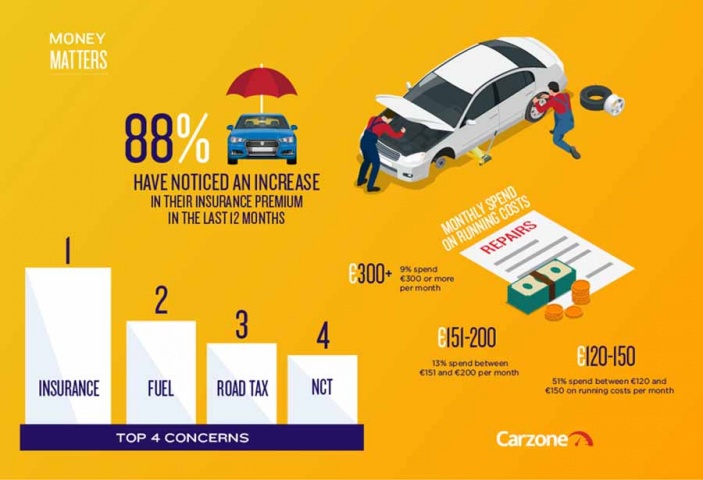

Of those surveyed, 88 per cent said that they viewed the cost of insurance as a significant concern, followed by fuel costs, motor tax, and the costs associated with the NCT check. Half of all respondents said that it costs them between €120 and €150 per month to run their car, with 31 per cent saying that it can cost between €150 and €200.

Diesel is still popular with Irish buyers, although it does depend on their location. 81 per cent of those living in rural areas said that they would buy a diesel for their next car, compared to 51 per cent for those living in urban areas.

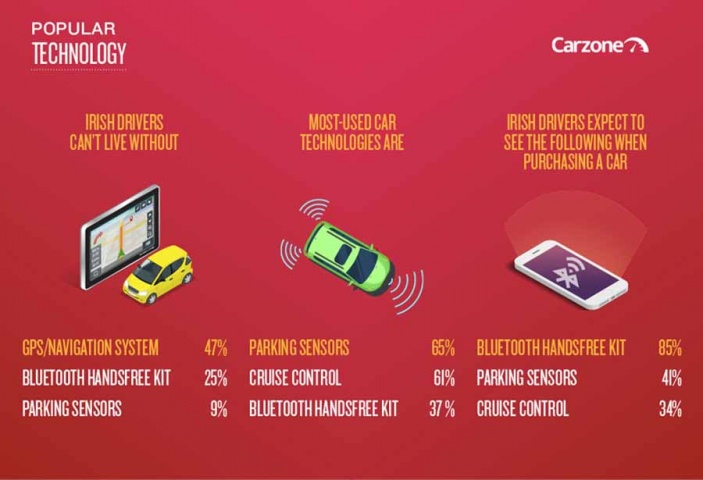

69 per cent said that in-car technology was now an important factor in their purchasing decision (although that's a percentage heavily skewed towards males - female buyers were less bothered about tech). Of those in the 25-34 year old category, 91 per cent cited technology as a major area of interest.

Two thirds believe tech makes driving more enjoyable, 47 per cent said that a sat-nav was a must-have, while 25 per cent said that they could not do without a Bluetooth phone connection. A significant 85 er cent say that they would expect to find a Bluetooth handsfree kit as standard while 41 per cent expect car sensors and a third (34 per cent) cruise control.

Significantly, given the incoming tide of car automation, 56 per cent said they would be happy to be a passenger in a robotic car, while 73 per cent said that autonomous cars would be on sale in their lifetime. Interestingly the biggest reservation noted by consumers was the fear of the car being hacked externally (41 per cent), 27 per cent said their biggest concern for self-driving cars is not being in control of the wheel themselves and 1 in 5 say they worry about a tech malfunction.

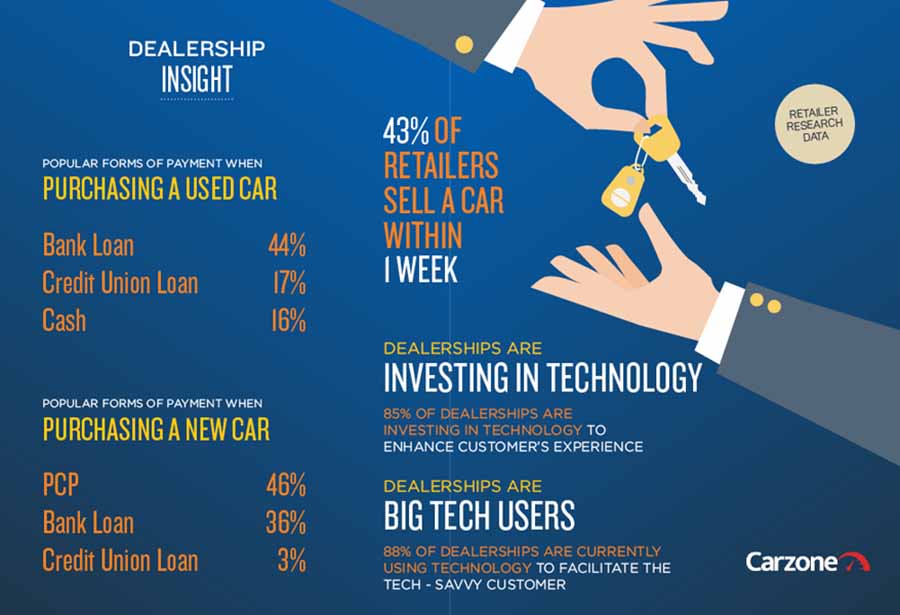

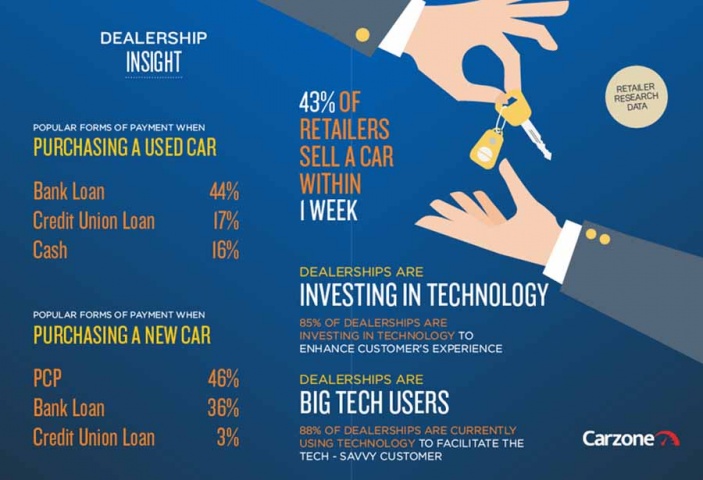

New to this year's report, Carzone questioned a cross-section of car retailers around Ireland on their views on the motor industry. Given that motorists are embracing technology, it's no surprise that 85 per cent of dealerships are investing in this area to enhance the overall customer experience. Wi-Fi in dealerships, 360-degree video and interactive tablets are the three key areas that car retailers plan to invest in during the next year.

The Volkswagen Golf remains the most searched for model on Carzone. However, jumping a massive six places to second place in this year's report is the new-shape Mercedes-Benz E Class. Premium car marques remain a firm favourite with Irish motorists with the BMW 5 Series, the Audi A6 and the Audi A4 all featuring in the top six.

Although electric and hybrid cars make up a smaller portion of searches on the site, interest in these cars has significantly increased in the first five months of 2017. The Nissan Leaf is the most searched for electric car on Carzone while the Toyota Auris takes the top spot in the hybrid stakes.

Commenting on the latest report, Ailish Tully, Brand Manager Carzone said: "The aim of the Carzone Motoring Report is to examine trends happening in the Irish motoring industry. This is the eighth edition of the report and this time around we delved into a number of new topics such as technology in line with the changing face of the industry. Rising insurance premiums remain a key concern for drivers with 88 per cent seeing the cost of their policy increase in the last year. However, the overall outlook for the industry is positive with consumers now changing their car more frequently and premium car marques are some of the most sought after vehicles by drivers. The subject of technology was one which revealed some interesting insights with in-car technology now an expectation rather than an added-bonus; especially among younger age groups. Dealerships across the country are also continuing to invest in this area to enhance their offering and connect with this new tech savvy audience."