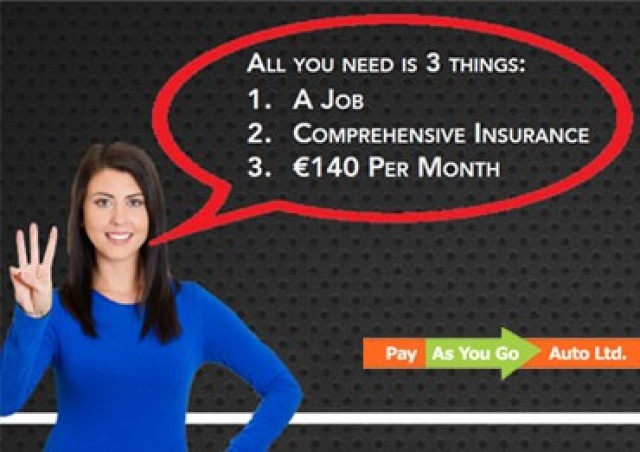

Here's an interesting one. The Mordaunt Group, one of Ireland's longest established networks of car dealers, is offering a new zero-interest car purchasing scheme aimed at those whose credit ratings would have them turned down by a bank or credit union. The Pay As You Go scheme offers those customers the chance to own their car outright in 24 months, with either weekly or bi-monthly payments following a deposit. Proof of current employment is needed, as is proof of comprehensive insurance.

According to George Mordaunt, "Our primary aim is to help struggling individuals by offering them a motoring solution within their financial boundaries. The ongoing introduction of strict credit terms has created a huge difficulty for people in their everyday motoring life. Mortgage arrears, visa card payments and other cash flow restraints have resulted in ordinary people being shut off from a day to day credit line that may have been previously taken for granted. Pay as You Go Auto has been created to counteract that difficulty and to assist people in a structured way allowing them to upgrade their vehicle."

"The global economic crisis has also struck the auto industry right from the beginning and with devastating effect. Corporate profits suffered, as did too the workforce, as hundreds of people lost their jobs. We are hoping that the introduction of www.payasyougoauto.ie will encourage change within the motor industry in Ireland."

Anything else?

The scheme is based on an American one and while it may seem like just the sort of sub-prime lending that got us all into this mess in the first place, it could well prove a lifeline for those needing a car but who have restricted access to credit.