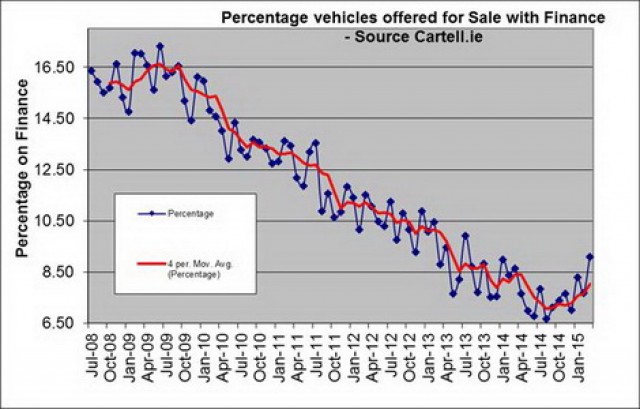

Some interesting results have come out of the latest research by Cartell.ie, the car history experts. Cartell has been checking the market to see how many second hand vehicles were on sale with finance still owing on them. The numbers have recently jumped significantly - from an all-time low of 7.01 per cent last December to 9.11 per cent in March - a jump of a third in just three months. Now, that signifies both good and bad things. On the good side, it means that more vehicles are being bought with a finance package, which means there's more available finance in the market - a good thing for the consumer. The bad news is that it means that there are more potential pitfalls for second hand buyers, who have to trust that finance owing on a vehicle will be paid off when they buy it.

"Our analysis shows that vehicle finance levels appear to have bottomed out late last year and are now surging back upwards. We anticipate further upward growth due to finance houses establishing a greater foothold in the market and the apparent growth in popularity of flexible Personal Contract Plans (PCPs) among consumers," said Jeff Ahern from Cartell.ie.

"These results continue to show the importance of checking for outstanding finance and the market is set to become more precarious for the used vehicle buyer as more and more vehicles are sold with finance outstanding. Every day customers are getting caught buying an older car assuming the finance has been paid off. Effectively, you can lose that vehicle as it remains the property of the bank until the last payment is made."