The cost of car insurance in Ireland continues to depend heavily on where you live, your age, driving experience, the car you drive and even your job title. That's according to the latest Car Insurance Pricing Index compiled by Chill Insurance, which compares average insurance premiums across the country.

The index, based on data from April 2024 to March 2025, offers a detailed look at how much drivers are paying, which counties are cheapest or most expensive, and what factors can make your premium higher or lower.

What affects how much you pay for car insurance?

Your car insurance premium is based on many factors, including your age, type of vehicle, where you live, your job, how much you drive and any claims you've made.

Which part of Ireland has the cheapest insurance?

Where you live matters; for example, in Connacht, the average premium is €689, making it the cheapest province. Ulster is the most expensive, averaging €796. Leinster comes in at €764 and Munster at €717.

Which counties are the most and least expensive?

Looking closer at counties, Leitrim tops the list for lowest premiums (€596 on average), with Kilkenny (€629) and Waterford (€643) close behind. On the other end, Longford is most expensive (€1,042), with Louth (€873) and Limerick (€838) also above average.

County Mayo saw a significant decrease this year, dropping from 11th to 6th place with an average of €671. In contrast, Offaly moved up ten places to 17th with an average premium of €744.

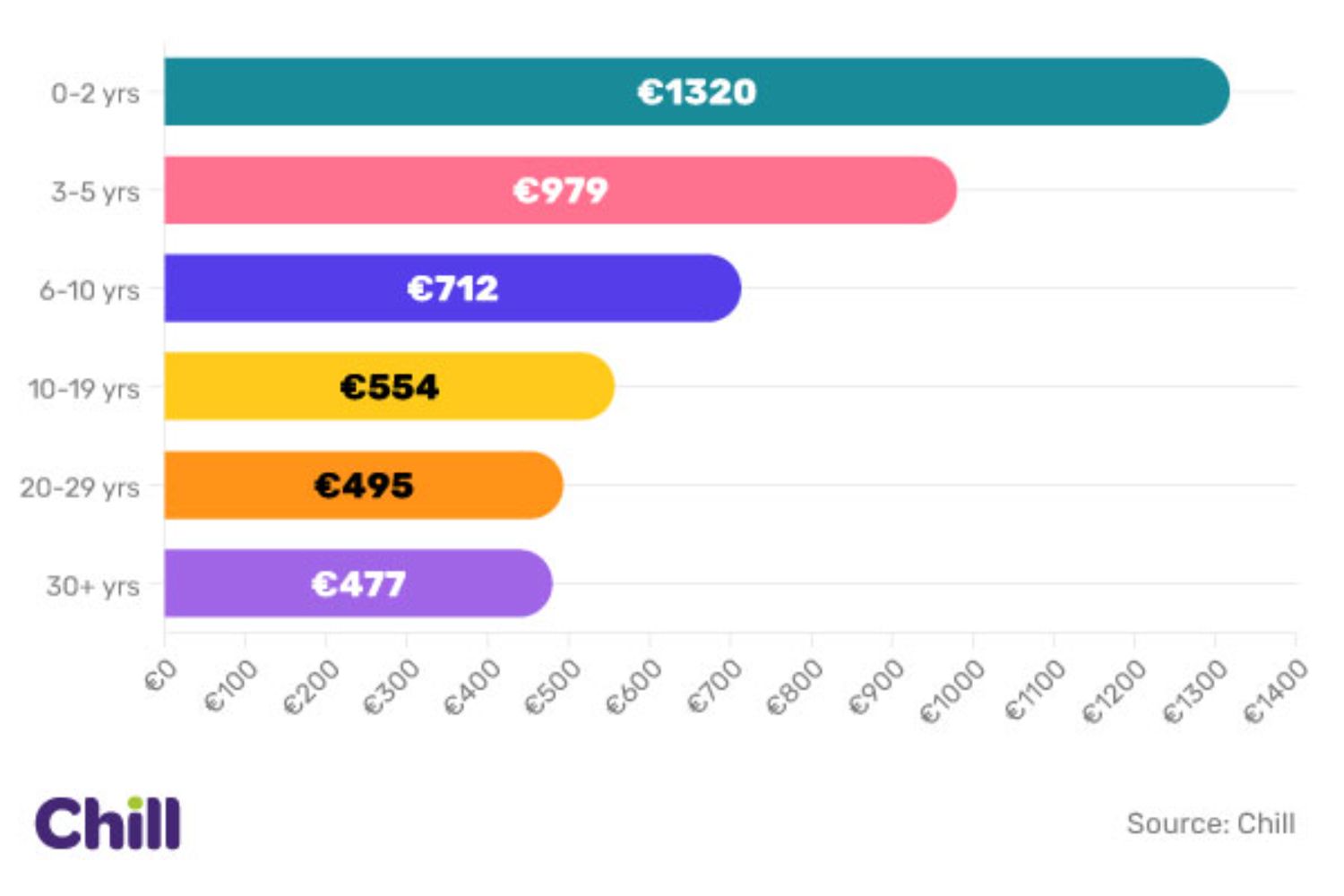

Do younger drivers always pay more?

Your age heavily influences insurance costs. The youngest group (under-19) pays around €1,884 per year, while 20-29-year-olds average €1,692. After three years of driving experience, premiums drop by around 27 per cent. More experienced drivers and those over 70 tend to pay less, thanks to safer driving records and strong no-claims bonuses.

Which cars are cheapest to insure?

Among popular models, the Kia Sportage, Hyundai Tucson and Skoda Octavia offer the lowest premiums. Dacia is the cheapest overall, likely because it sells fewer models, often driven by older, low-risk motorists. Insurance costs hinge on a car's age, value, size, safety and security features, repair costs and how often it's involved in accidents. Modifying your car can also increase the premium.

What about electric cars?

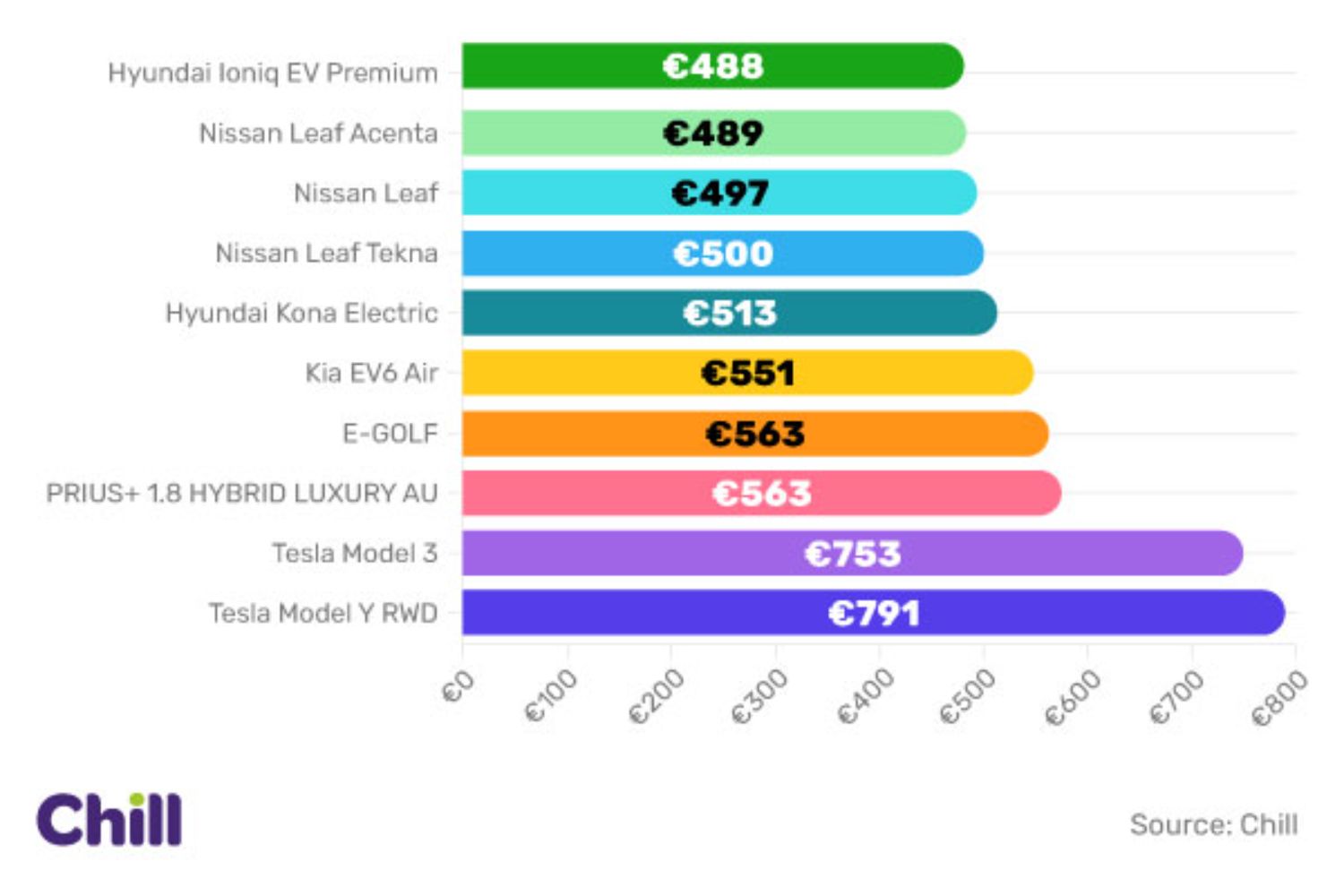

When it comes to insuring an electric vehicle in Ireland, the Hyundai Ioniq EV Premium offers the lowest average premium at €488, making it the most affordable among the top models.

Close behind are two versions of the Nissan Leaf, with the Acenta model averaging €489 and the standard Leaf at €497. The Nissan Leaf Tekna comes in at €500, while the Hyundai Kona Electric is next at €513.

Insurance costs begin to rise more notably with the Kia EV6 Air, averaging €551, followed by the Volkswagen e-Golf. However, premiums increase significantly for Tesla models, with the Model 3 averaging €753 and the Model Y RWD topping the list at €791.

These figures highlight the wide variation in insurance costs across electric cars, with smaller, more established models offering greater savings for drivers compared to newer or higher-end electric vehicles.

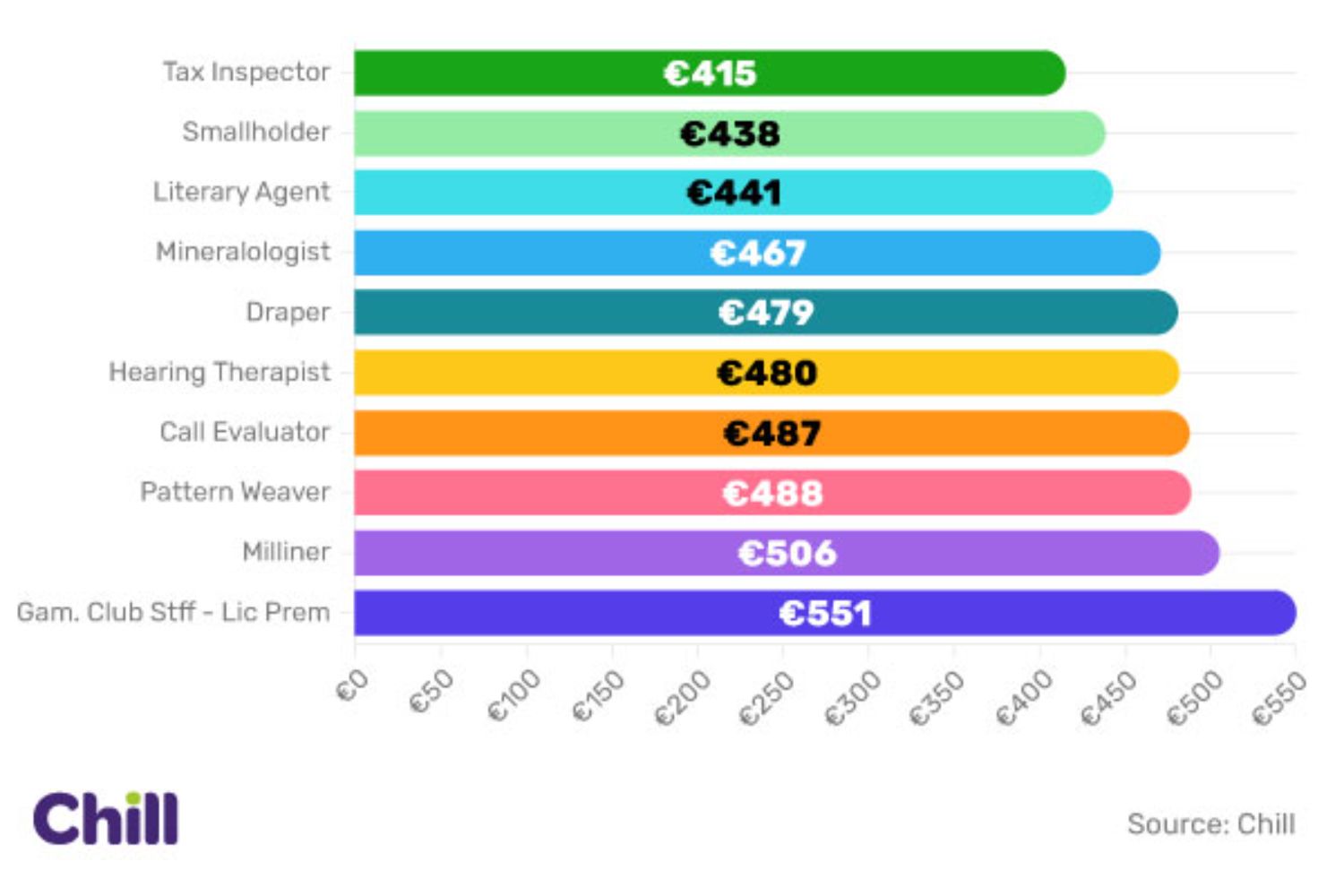

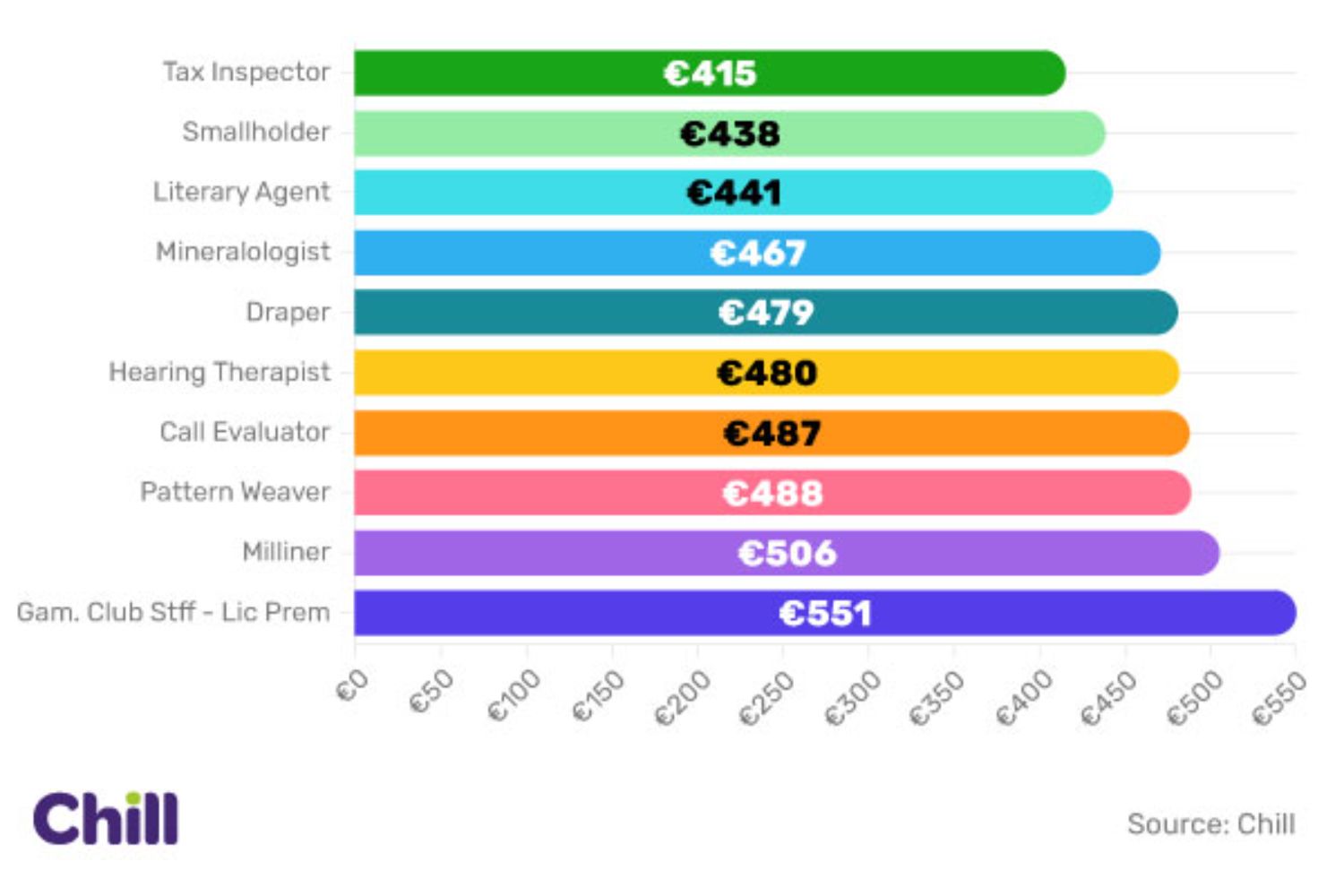

Does your job affect your insurance?

Yes, you might be surprised. The cheapest profession to insure? Tax inspectors, at around €415 per year. Office or remote workers usually drive less and stick to quieter roads, which makes them a lower risk to insurers, while established careers, stable schedules and limited mileage all help to bring premiums down.

You can find the full details of the study here: https://www.chill.ie/blog/car-insurance-pricing-index/